|

|

|

|

|

|

| Medawar Market Musings | August 2024

|

|

|

|

| Are you interested in passive real estate investing opportunities?

|

|

|

|

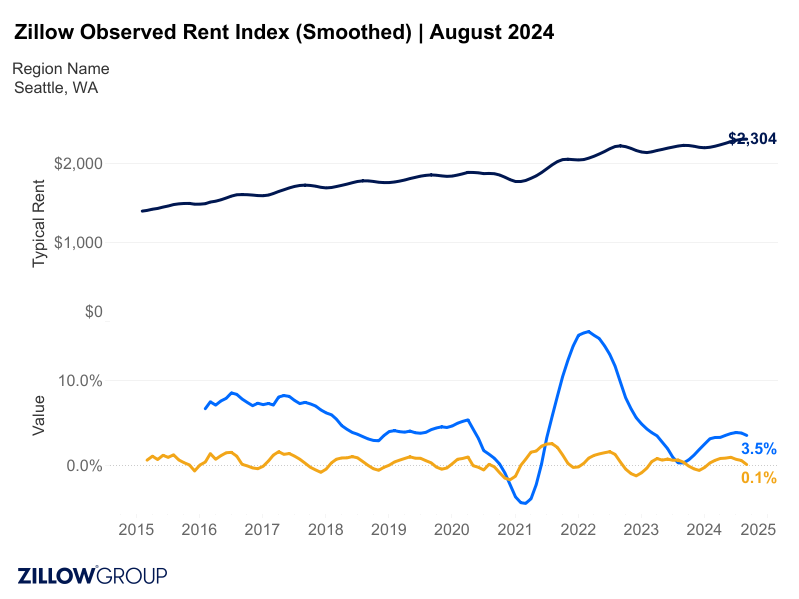

Would you like to participate in Seattle’s strong apartment market without all the work of managing residents, fixing toilets, and renovating units? We recently finished our first real estate syndication and the project is going great for our investors. We will be doing more. Here is how it works:

-

We identify an apartment building to purchase. We inspect the property, perform due diligence, estimate renovation costs and rents, and determine if the project is suitable. If the project meets our criteria we move forward with the purchase.

-

Accredited investors are invited to participate in the syndication. The investor (the “Limited Partner”) contributes money to the partnership.

-

We (the “General Partner”) contribute our own funds to the partnership and sign on the loan, usually a personal guarantee. We close the purchase, perform renovations and due diligence, find great tenants, and either sell or refinance the loan.

-

After the project starts cash flowing or after a sale or refinance, Limited Partners receive a “Preferred Return” before the General Partners receive any performance fees, usually 6-8% annually on the investment.

-

After the Limited Partners receive their Preferred Return, any additional return is split between the Limited Partners (usually 70-80% of the excess return) and General Partner (usually 20-30% of the excess returns).

We are actively pursuing investment opportunities in the Seattle market. If you have any interest, please let me know and I will schedule an initial consultation.

|

|

|

|

|

|

|

|

|

|

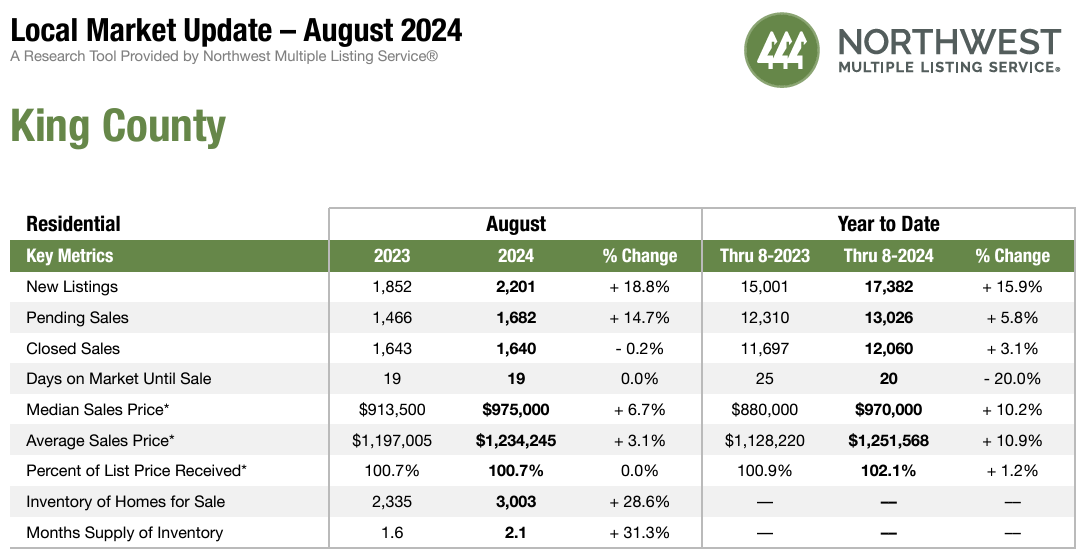

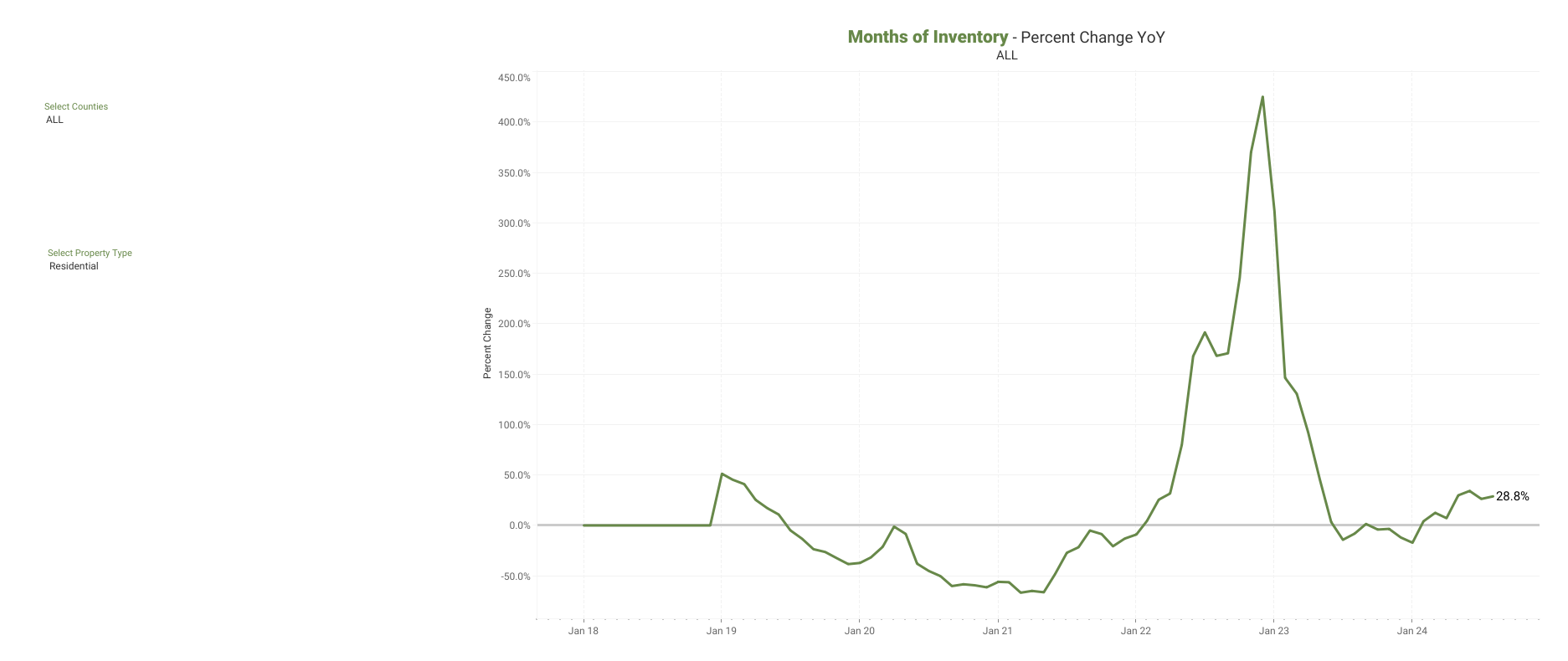

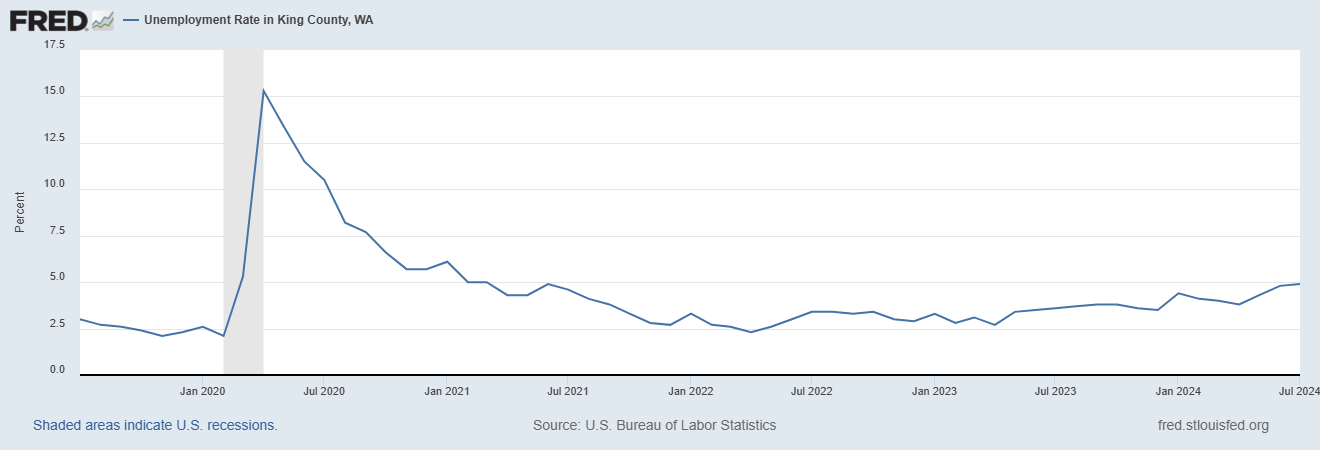

The rental market and for sale market remain strong but are cooling in line with normal seasonality trends. Demand for rentals and purchases is much higher in the spring and summer months and cools off in the fall and winter. Months of Inventory is up 31.3% year over year. It would now take 2.1 months to sell all the active listings on the market, which is the highest in the post pandemic era but still historically low. Months of Inventory in August 2019 (still a strong housing market) was also 2.1.

|

|

Market Recap

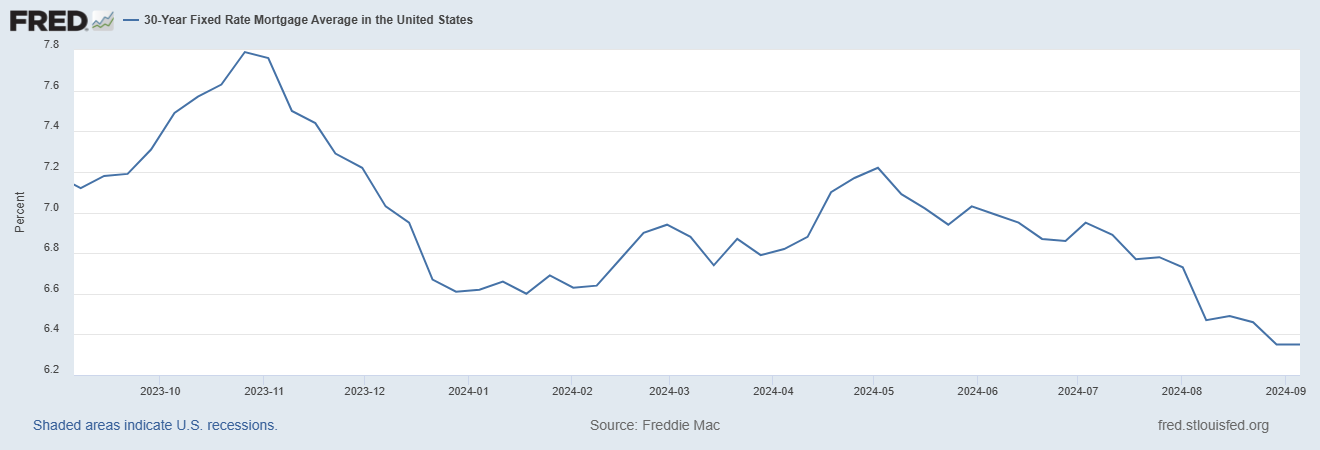

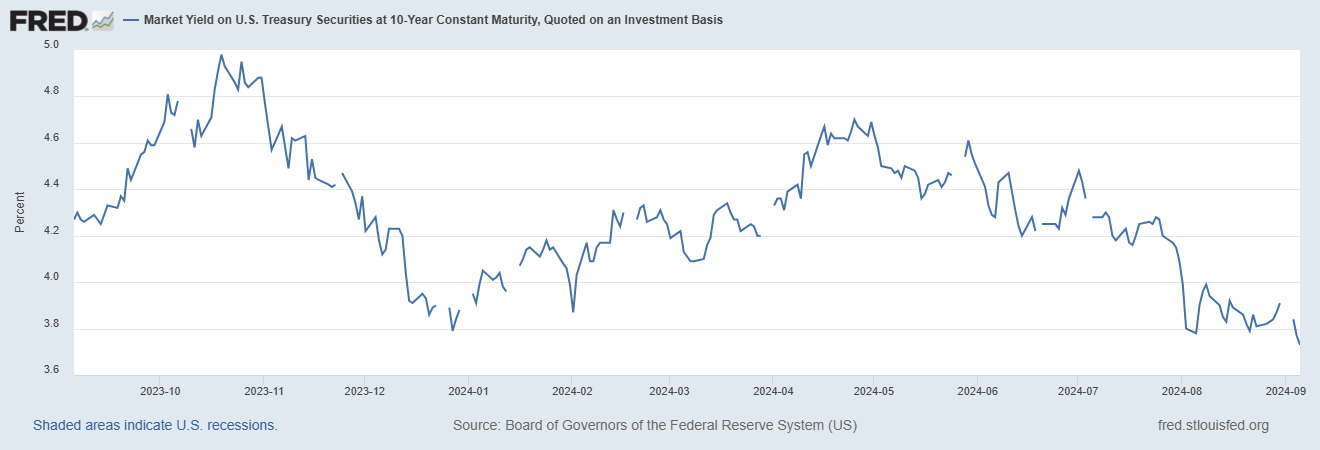

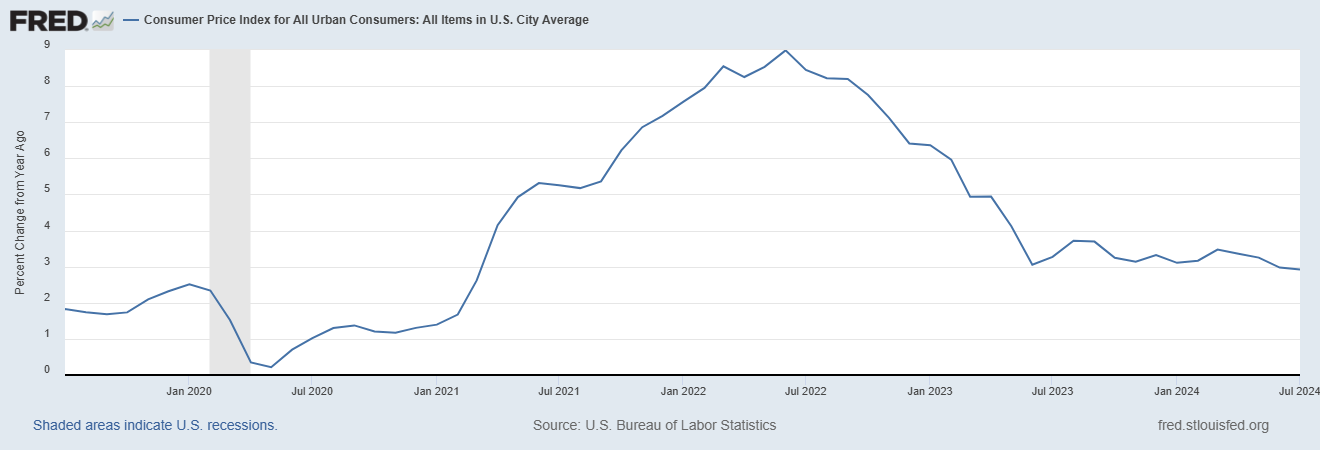

Mortgage rates are at their lowest level since March 2023 (6.35% for a 30-year fixed rate mortgage as of August 29th), and August 2024 reflected year-over-year increases in the number of active listings, new listings and pending sales. At the same time, the number of closed sales year-over-year was virtually unchanged, and median home prices rose in 20 of the 26 counties covered by NWMLS. The Federal Reserve is expected to further reduce interest rates in September, sending encouraging signals to potential buyers.

August 2024 Key Takeaways

Active Listings

-

There was a 34.1% increase

in the total number of properties listed for sale, with 15,453 active listings on the market at the end of August 2024, compared to 11,525 at the end of August 2023.

-

The number of homes for sale increased throughout Washington, with 25 out of 26 counties seeing a double-digit year-over-year increase

.

-

The five counties with highest increases in active inventory for sale were Douglas (+65.1%), Mason (+49.2%), Lewis (+49%), Pacific (+48%) and Pierce (+43%).

Closed Sales

-

The number of closed sales remained relatively unchanged

year-over-year (6,727 in August 2024 compared to 6,734 in August 2023).

-

15 out of 26 counties saw an increase in the number of closed sales year-over-year, while 11 saw a decrease.

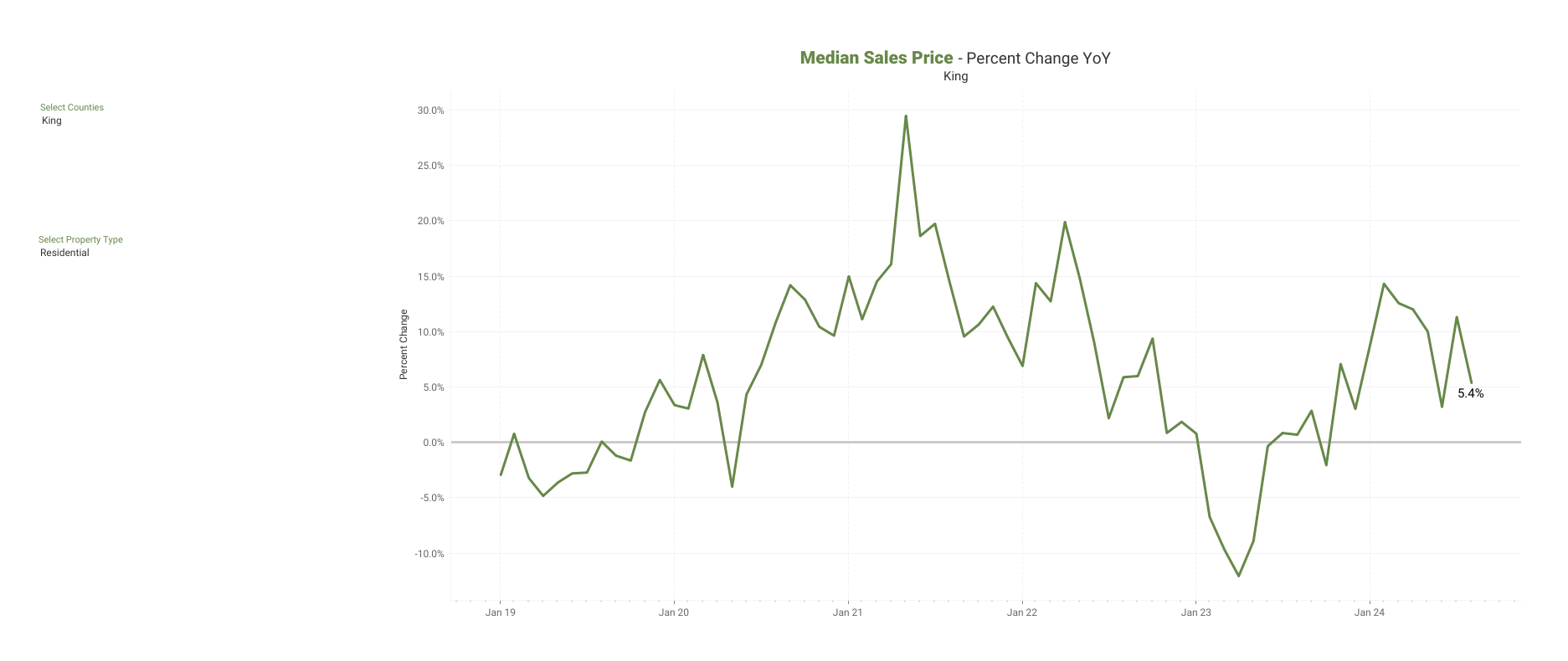

Median Sale Price

-

Overall, the median price for residential homes and condominiums sold in August 2024 was $645,000, an increase of 4.9%

when compared to August 2023 ($615,000).

-

The three counties with the highest median sale prices were San Juan ($905,000), King ($860,000) and Snohomish ($762,500), and the three counties with the lowest median sale prices were Ferry ($282,500), Adams ($307,475) and Pacific ($332,500).

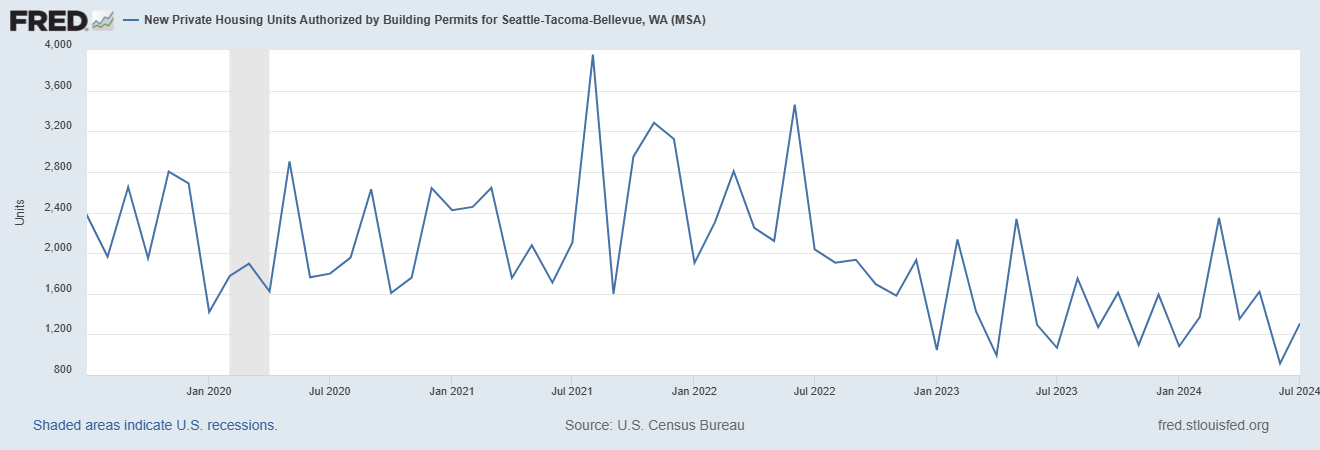

“Mortgage interest rates have already started to moderate, dropping to 6.35% (for 30-year terms) at the end of August from this year’s high of 7.22% at the beginning of May,” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington. “Unfortunately, lack of supply is going to continue to be an issue affecting house prices. Single and multi-family permitting dropped off noticeably in 2022 as interest rates ramped upwards, and single-family home prices will likely continue to increase as interest rates drop.”

Consumer and Broker Activity

NWMLS also provided insights into consumer activities during the month of August 2024:

-

Keyboxes

located at listed properties were accessed 159,239 times in August 2024, a 2% increase in activity from July 2024 when they were accessed 156,268 times.

-

The total number of property showings

scheduled through NWMLS-provided software saw a 2% increase from July 2024 (117,298 showings) to August 2024 (119,927 showings).

-

In August 2024, there were 18,028 listed properties that were eligible for the Down Payment Resource

(DPR) program offered by NWMLS, an increase of 3% over July 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|